Accelerator for Banking

home

Note: This accelerator has been superceded by the MuleSoft Accelerator for Financial Services.

Legislative, market, and technology trends have created a digital transformation imperative in financial services. Accelerator for Banking includes pre-built APIs and a prescriptive architecture to help IT teams jumpstart the development of common banking applications and provides a foundation for 3x faster project delivery.

Key Components

- Support for core business processes – Account information, payments initiation and legacy modernization use-cases.

- Architecture best practice – Accelerator for Banking provides a proposed architecture – one drawn from working with industry leaders – that promotes asset self-service and reuse.

- Pre-built API designs and implementations – Following PSD2 trends and regulatory requirements, MuleSoft has built a series of AISP and PISP APIs that unlock core business data via secure APIs.

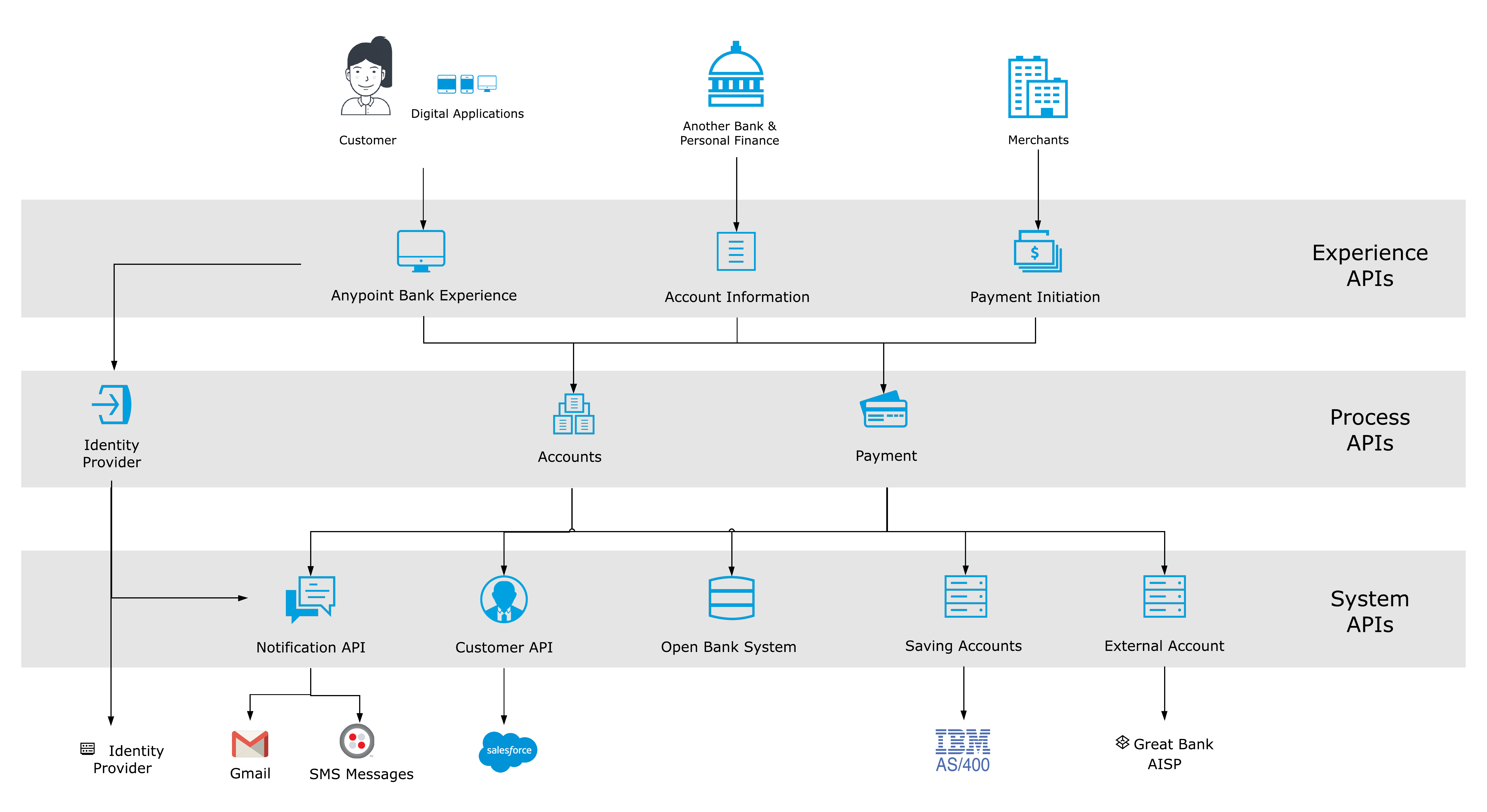

API-Led Microservices Architecture for Banking

In addition to providing pre-built APIs, Accelerator for Banking includes a model for API-led connectivity in banking that promotes asset reuse and self-service. In the below architecture, we’ve abstracted data from complex banking systems like AS400 into a canonical model that is represented via a set of Open Bank REST APIs. Then, we build experience APIs that provide better experiences for both customers and API consumers.

System Layer

System APIs abstract away the complexity of core banking systems of record from the data’s end user, while providing downstream insulation from any interface changes or rationalization of those systems.

Assets Included:

- Customer System API | RAML Definition

- Customer System API | Salesforce Implementation Template

- Open Bank System API | RAML Definition

- Open Bank System API | AS400 Implementation Template

- Notification API | Gmail and Twillio Implementation Template

Process Layer

Process APIs decouple business processes that interact with and shape data from the source systems where the data originated. For example, the “process a payment” contains logic that is common across multiple entities, which can be called by product, geography, or channel-specific parent services.

Assets Included:

- Autorization Server API | RAML Specification

- Autorization Server API | Implementation Template

- Accounts Process API | RAML Specification

- Accounts Process API | Implementation Template

- Payment Process API | Implementation Template

Experience Layer

Experience APIs are the means by which data can be reconfigured so that it is most easily consumed by its intended audience, all from a common data source, rather than setting up separate point-to-point integrations.

Assets included:

- Anypoint Bank Experience API | RAML Specification

- Anypoint Bank Experience API | Implementation Template

- Account Information Service Provider (AISP) API | RAML Specification

- Account Information Service Provider (AISP) API | Implementation Template

- Payment Initiation Service Provider (PISP) API | RAML Specification

- Payment Initiation Service Provider (PISP) API | Implementation Template

Supporting Assets:

- OAuth 2.0 JWE access token enforcement | API policy

- Resource specific Client ID Enforcement | API Policy

- Two-factor authentication | API policy

- Account Information Server Provider (AISP) | API Notebook

- Payment Initiation Server Provider (PISP) | API Notebook

Give it a try and if you have questions or feedback, let us know at info@mulesoft.com.