MuleSoft Framework for the Small Business Administration Paycheck Protection Program

home

Overview of Framework Assets

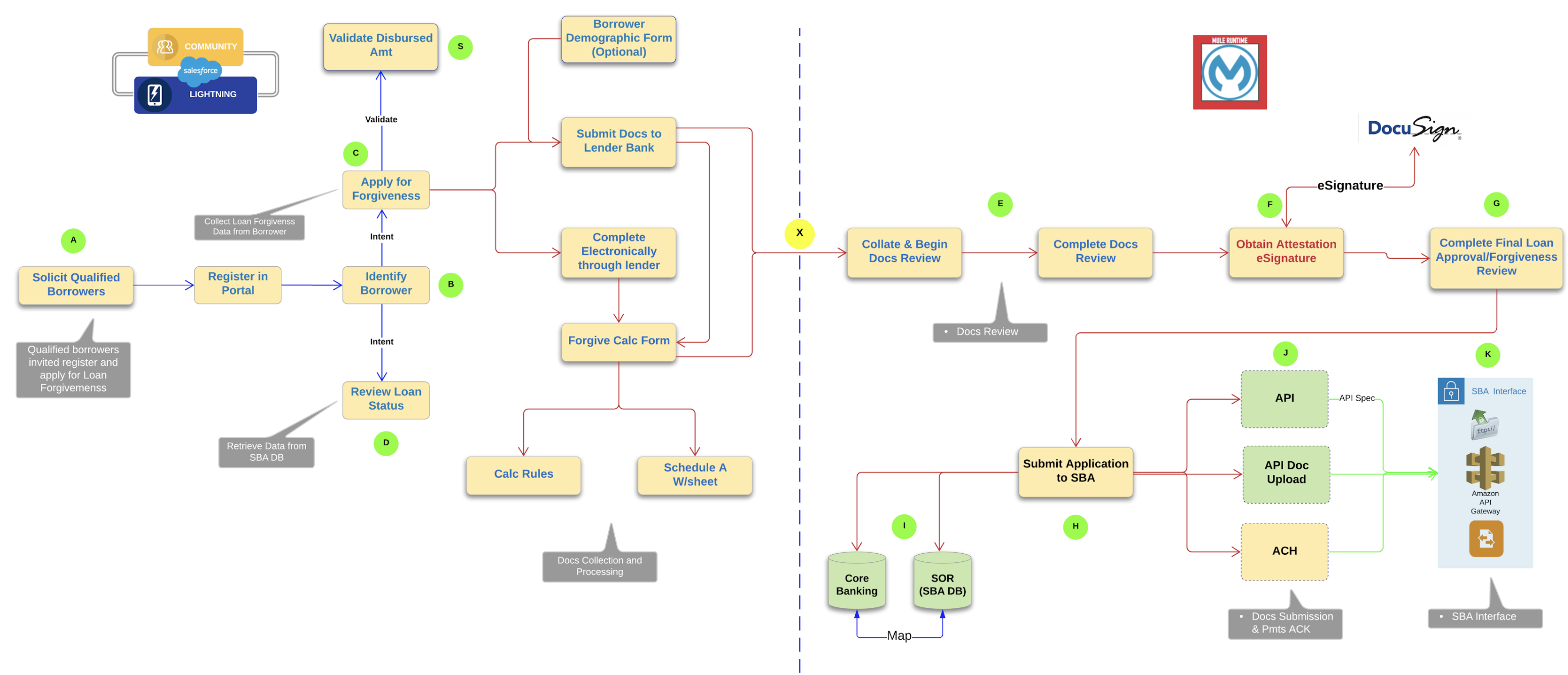

MuleSoft’s Framework for the Small Business Administration (SBA) Paycheck Protection Program (PPP) encompasses four assets:

A Forgiveness Integration Template makes it easier for lenders to submit forgiveness applications to the SBA via their new REST APIs.

Eight MuleSoft APIs help lenders streamline internal operations around calculating forgiveness amounts, collecting loan documents and signatures, and updating customer data in systems of record. These APIs are listed below:

- System API for SBA E-Tran

- System API for SBA Database

- System API for DocuSign (eSignature)

- Process API for SBA E-Tran

- Process API for Documents

- Process API for Loan Forgiveness

- Experience API for DocuSign

- Experience API for Salesforce Communities

A reference architecture provides guidance on how to implement the Framework components and adapt them to your specific technology stack.

Partner connectors from Codat and Glynt are certified to support adjacent use cases, such as expense verification and document digitization, that will make it easier to gather the data necessary for processing loan and forgiveness applications.

System API for SBA E-Tran

Lenders can get started with the Framework by using this RAML API and implementation template to interact with the SBA’s E-Tran system.

This API encapsulates the logic for sending all loan data to SBA E-Tran. Coupled with the Framework’s Process API for SBA E-Tran, lenders can retrieve loan applications from their back-end system of record, submit the loan applications, and immediately upload supporting documents to E-Tran by fetching the supporting documents from the SFTP folder location of the borrower.

Use Case

As an SBA lender, I want to streamline loan and forgiveness application intake and decisioning and accelerate application submission to the SBA.

Using the Framework’s APIs, I can connect front-end application intake portals such as Salesforce Communities with back-end systems of record such as core banking and loan servicing where forgiveness calculations are computed and recorded. In addition, collecting and submitting borrower documents and attestations are made easier via the Framework’s Document and DocuSign APIs.

Getting Started

Lenders can get in touch with us here to discuss the implementation of these assets through our Professional Services team. Because the Framework is modular, not all of the assets need to be deployed — lenders can pick and choose the ones that are most relevant for their technology stack and business processes.

We look forward to partnering with you to reimagine SBA lending for the remainder of the PPP and beyond.